Senz Chocolates

Update of Positioning

The Senz brand and products were created especially for the Chinese market: a disruptive, contemporary, emotional and personal brand with a unique selling proposition – the first exclusively dark chocolate range, prepared by Belgian chocolatier. From the initial analysis of secondary data, it seemed that the positioning was not communicated strongly enough and there were doubts whether the brand is known, and regarding how consumers are reacting to Senz.

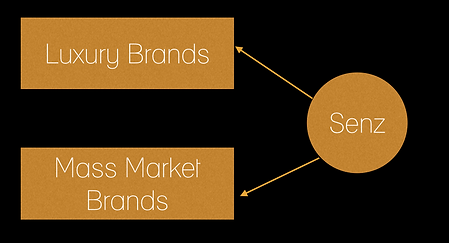

The primary data gathered during the research stage highlights that, although Senz is only recognized by 21.49% of the sample, 78% of these consumers would recommend the product, an impressive number for a brand which doesn’t share the spotlight of the first ranks of the market, as Dove, Snickers, Ferrero Rocher and many other foreign brands. This was an essential question which needed answering: indeed Senz has a unique and strong positioning on the market, but where does it stand versus mass market and luxury brands? The difficulty of giving a straight forward answer resided in the fact that its bars prices were a bit higher than Dove’s, but at the same it was present in other categories – truffles, boxes etc.– with premium packaging (i.e: tin box, individually wrapped chocolates) trying to attract more high level consumers from the luxury brands. But being in the middle is never a good option; therefore clarifying who the competitors are or should be, was one of the main objectives.

Market Overview

There is room for growth, especially considering that the chocolate market has been growing for the past couple of years and the trend will definitely continue. Already, it can be seen that chocolate is not only consumed for special occasions, but also as a regular snack or as an indulgence.

-

Potential market: The middle class is expected to reach 340 million people in the upcoming period and considering that the chocolate market is also set to expand, it can be inferred that the average frequency can grow to a daily rate of product consumption. This results in 2.1 billion chocolate units per week. Out of this total, people who are allergic to cocoa (less than those allergic to milk) can be excluded in order to determine the potential market for dark chocolate only. However, the percentage at global level is extremely small, which makes the number calculated above valid to be considered the potential market for dark chocolate as well.

-

Actual market: At this moment, 300 million people have access to chocolate and the predominant eating frequency is 2 times per week, which can result in 600 million units per week.

-

Targeted market: The fragment of the market that Senz is considering is the dark chocolate market, which stands at 39.25% (the percentage of survey respondents who chose dark chocolate as their absolute type of chocolate preferred), meaning 235.5 million units per week.

-

Penetrated market: 21.49% of respondents know Senz, which means the brand supposedly reaches 42.12 million units per week in the 1st Tier cities where it is present. The specific potential market for Senz, considering its expansion into 2nd and 3rd Tier cities, might be considered to grow 10% more in one year in an additional 5 Tier 2 and 3, respectively cities, which would amount to 65 million units per week.

To conclude, Senz has great brand assets: premium product, appealing packaging, a good market opportunity, it has only to communicate it in an appealing way. The creative strategy is detailed here.

Looking at the results of the survey, there is a strong affinity between the demographics of the consumers who prefer Senz and those who are fans of mass-market brands. However, the proposition that Senz is offering the market – unique recipe prepared by Belgian chocolatier, premium packaging – must not be put aside.

The new positioning, which reconciles this dilemma is that Senz will be the “H&M of chocolate”: good quality, at a fair price, with high-end launches from famous Belgian chocolatier. This way, over 90% of the time, Senz will compete with mass-market brands, while in key moments of market activation (holidays, for example), it will prepare personalized assortments to appeal to upper middle class and even upper class. This is supported also by the results of the survey: the frequency of eating chocolate is higher among mass-market brands, whereas respondents with very high monthly income, of over 7500 RMB appreciated Senz for its taste.

The age target remains 18-45, with strong focus on 20-34. The first group 20-24 includes the biggest fans of dark chocolate, therefore it is important to offer them a product they can appreciate and become loyal to.

Positioning statement:

1. For the sweet-toothed consumer ages 18- 45, who is learning to appreciate the finer things in life, at a fair, not necessarily low price

2. China’s first exclusively dark chocolate brand

3. Because Senz’s Belgian chocolatiers perfected a unique recipe of dark chocolate for the Chinese market

When it comes to the geographical distribution, Senz has the strength to expand and target both Tier 2 and 3 cities, as well as big urban conglomerates such as Shanghai, Hangzhou, Beijing, and Guangzhou, regions where they are already present. The strategic approach is to organize the markets as clusters, as these share more than proximity: they have close trade relationships and common economic outlooks, and most importantly, consumer preferences. By using big data and tracking feedback, Senz can adapt its communication according to each region.

An example might be the attraction towards Chinese brands in Tier 2-3 cities vs. Western brands in urban conglomerates. Senz can play its strengths in both regions : as a personalized product for this market, produced in China for the first one and as a prestigious brand with Belgian legacy in the other one.