Senz Chocolates

Define problems and objectives

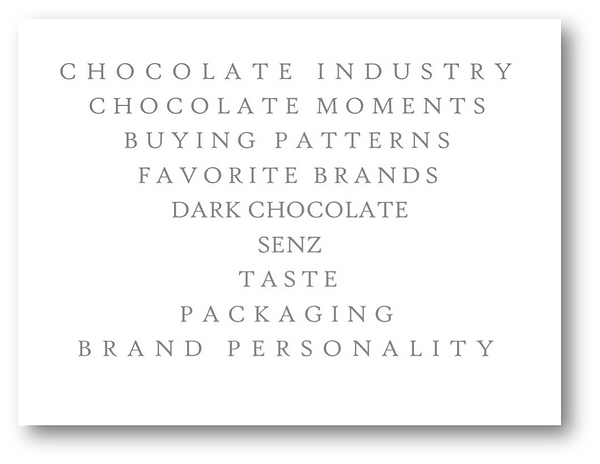

Senz is an innovative newcomer in the Chinese chocolate market, with a unique approach towards its product range. It attempts to appeal with creative and sensual visuals and dark, sophisticated attitude. Currently, the daily consumer market is dominated by Western, milk chocolate brands while seasonal gift sales are controlled by high-end chocolatiers and both are promoted through very strong integrated communication campaigns. Senz is neither a brand that appeals to a new chocolate consumer and nor does it have a strong marketing campaign, therefore it lacks the consumer friendliness of the milk chocolates and the driving forces needed to penetrate the sophisticated markets.

Our objective is thus to understand what drives the Chinese consumer to purchase, eat and enjoy chocolate, to get the overall picture. With this understanding, we will see where Senz fits in the picture and how it can move forward to improve its position.

Research plan

BRAND AWARENESS

How frequently, if at all, does Senz come to mind when the Chinese consumer thinks of chocolate? What about dark chocolate in general? Who is overshadowing Senz’s presence in the market? These are the main questions that need to be answered through research in order to better define Senz’s effort of reaching the consumers.

BRAND IMAGE & ATTITUDE

For consumers who know the brand, how is Senz perceived and what ideas and emotions come to mind; does Senz evoke brand loyalty in its current consumer base? For buyers who don’t know Senz, how does the product’s name, packaging, and overall presentation influence their decision whether to buy Senz or not? Do they influence it negatively or positively?

BRAND RESPONSE

Senz falls under the overall cultural trend of the Chinese chocolate market and is subject to the choice of consumers to get chocolate for personal consumption or as gift giving. Brand perception and price affect the product’s versatility within the market.

BRAND RESONANCE

Since chocolate is perceived as a Western treat, the Chinese consumer tends to favor foreign brands. Despite this, it is important for the consumer to be able to identify and relate with the products, to feel closer attachment. It is important to see if Senz’s presentation as a dark chocolate only brand, as well as its disruptive and sensual branding as life expression is culturally compatible to Chinese costumers. To sum it up, the question is how relationship marketing functions in China, and if Senz can make use of it to make a real connection with the consumers.

Techniques

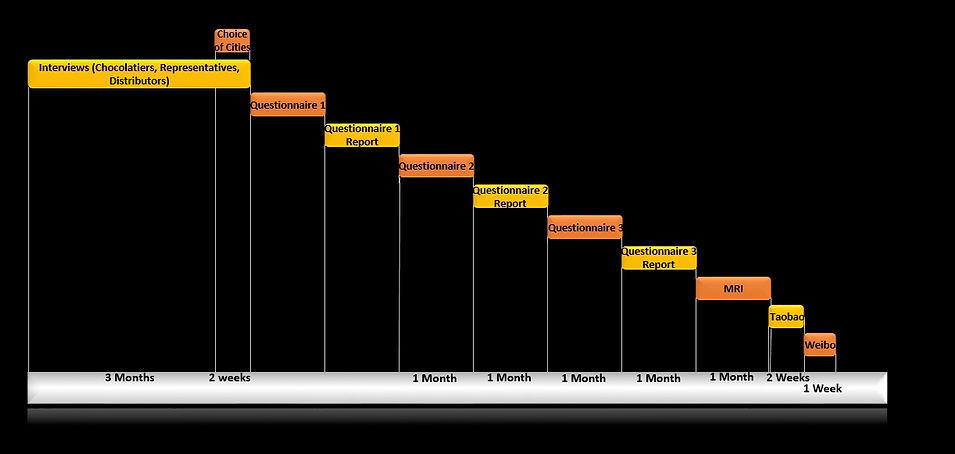

Ideal market research plan

To conduct the research, surveys and interviews will be implemented for three segments of chocolate related targets: consumers, sales representatives and distributors and connaisseurs (chocolate experts).

The purpose of these three instruments is to understand the overall dynamics of the chocolate industry from the consumers’ point of view (the purpose of buying, typical moments when the product is enjoyed, which category is chosen for which moment etc.), the influence of price on buying decision, feelings towards other brands and, if people know Senz, how do they respond to the proposition of the brand.

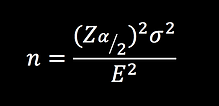

The ideal scenario for applying the questionnaire would be a 3-stage process: first one to discover market trends and preference of brands, second one to get insights on dark chocolate – reasons for consumptions and possible substitutes perceived, and lastly, an in-depth look into how Senz touches upon consumer expectations. These questionnaire would be applied both online to cover major Tier 1, 2 and 3 cities and in specific locations directly. The sample size would be calculated according to the following formula.

Z=confidence level at 95% (standard value of 1.96)

б = population standard deviation – in our case, it is the difference from total population and the part of it which has access to chocolate; it refers to the percentage of population who has access to chocolate, which according to Forbes is 300 million out of 1.3 billion (2010). Therefore, our standard deviation is set at 23.07%.

E = margin of error, set at 5% as it is suitable for opinion, market and social research

Computing the numbers, the result indicates that the required minimum sample size for the smallest strata, under optimal conditions, be set at 82 (rounded up from 81.78). Strata will be determined accordingly, per city.

Sales representatives should also be interviewed to try and understand buying patterns. Their answers will be confronted with feedback from distributors. The main findings to look for are: level of price margins, frequency of offers, and effectiveness of special activations within the stores.

Belgium and Chinese chocolate experts will be interviewed to get testimonials which can be transform into claims for future campaigns. Considering that Chinese consumers respond very well to celebrity endorsement, it would be helpful to develop business relationships with celebrities that match the profile of our brand, and who are appealing to our target. The collaboration might start as an “exclusive tasting event” during which data can be gathered.

With enough funding, MRI tests should be included in the plan to detect where within the brain does chocolate create reactions such as the frontal lobe or the dopamine receptors or other pleasure generating sections of the brain and see if there are differences between brands and types of chocolate.

The research will be completed by two creative approaches, at the frontier between communication campaign and survey. On the online selling channels where Senz products are featured, a discount will be offered to Chinese consumers when they are ordering a Senz product under the condition that they filled out a short survey or they leave a review. This way, the opportunity will be created to gather insights from the consumers on the products. In order to verify if the communication is culturally compatible and accepted, a hashtag one-week campaign on Weibo will be organized, during which consumers will be encouraged to share their thoughts on how they experienced the joy of life every day. This way, a better understanding of what drives the consumer will emerge which will enable the brand to connet to special consumption moments.

Research plan timing:

Team 1 Research plan

Considering time, language and resource constraints Team 1 will concentrate their efforts on implementing a single questionnaire in Shanghai targeting chocolate consumers. The focus on representative spots for the middle class. The target sample size will consist of at least 82 people, without taking into account the strata boundaries.

Team 1 timing

Implementation of questionnaire : Nov. 27th – Dec. 1st

Analysis of questionnaire : Dec 1st – 3rd

Presentation of findings: Dec 4th